Banking

Banking

There is no one quite like us. You get:

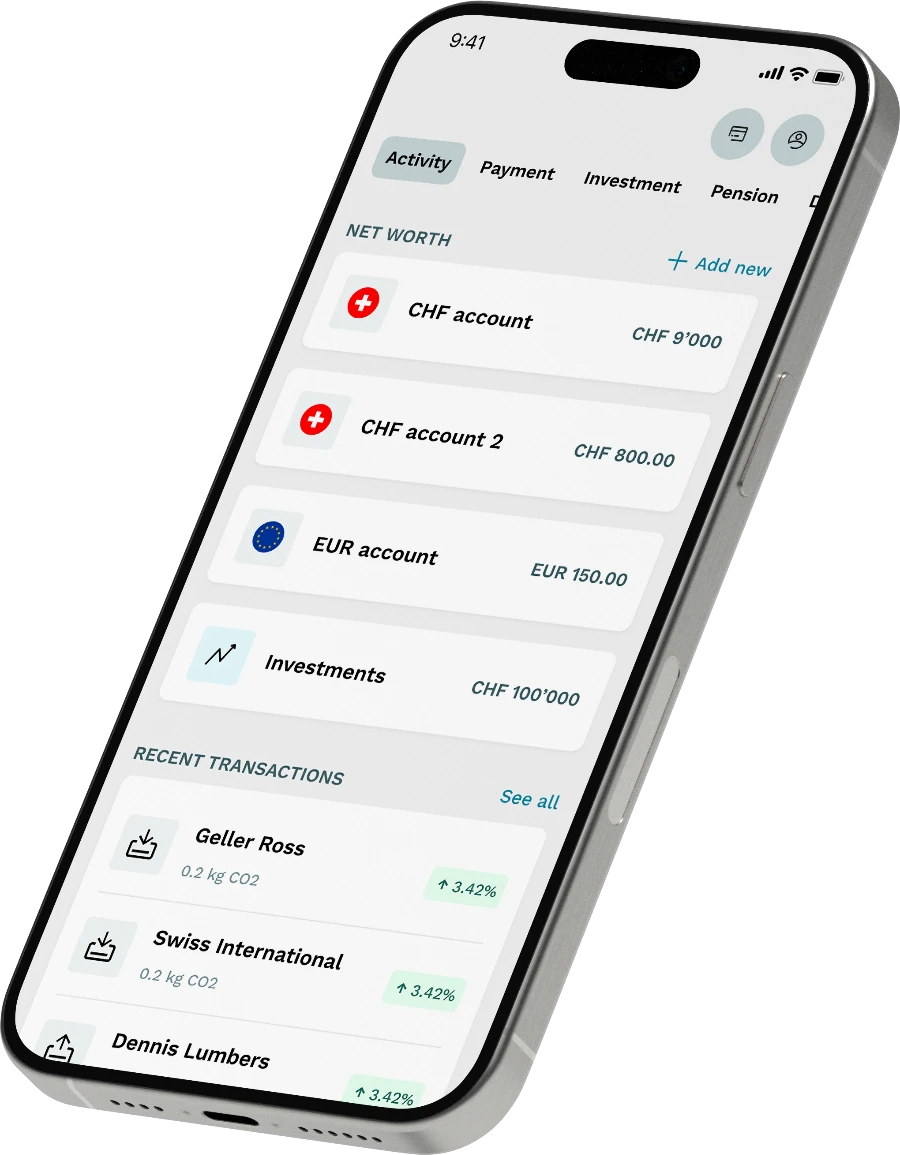

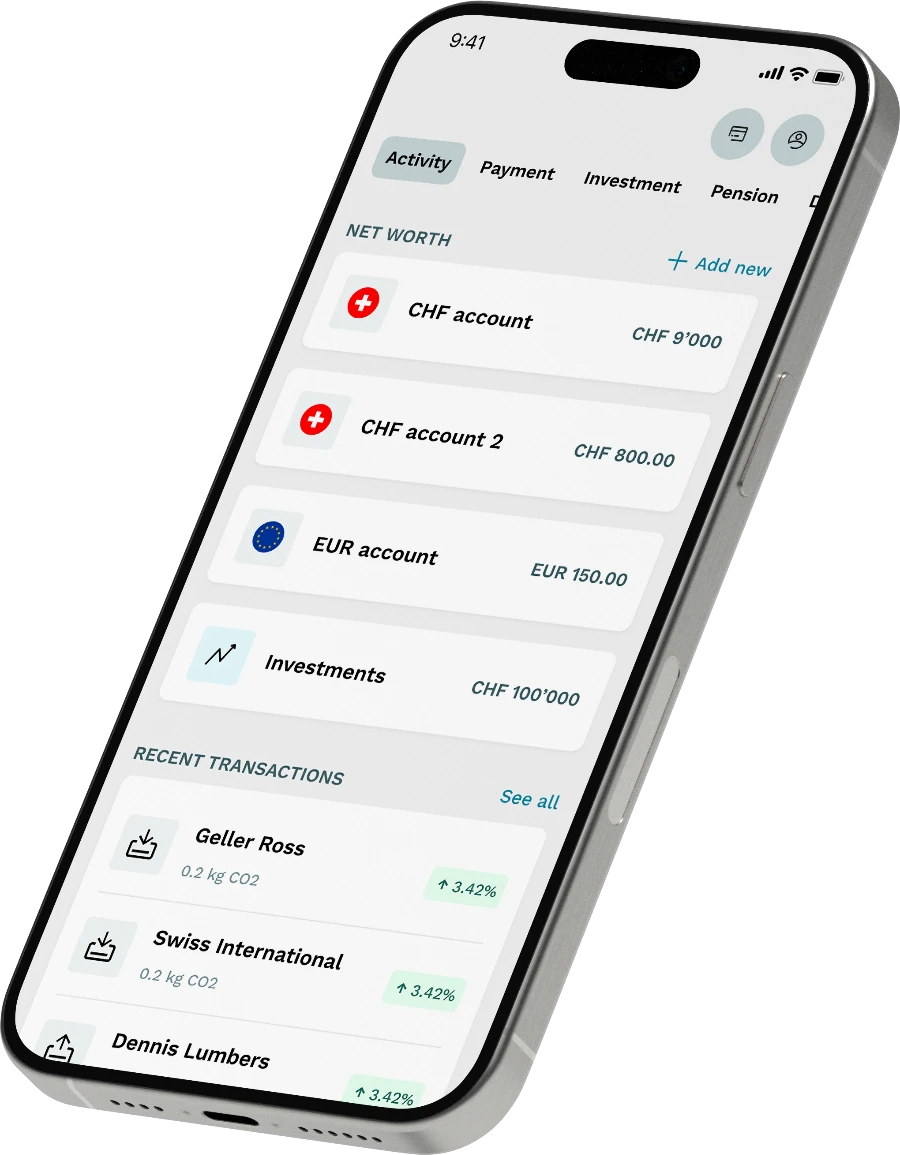

✓ 0% fees for card payments in any currency1

✓ Up to 10% Saveback on card spending2

✓ 0.1% interest on your CHF accounts and up to 0.5% interest on your EUR account with no withdrawal restrictions3

✓ Free travel insurance included

Set up a monthly investment savings plan and get up to 10% of your card spending deposited into your investment portfolio.2 Saveback is like a little reward for using your radicant debit card!

Enjoy free shopping abroad - online and in-store. No Visa markups, no transaction fees, nothing. When you use your radicant card, we apply the interbank buy/sell rate, ensuring you receive fair exchange rates.

Benefit from market-aligned interest rates on your accounts with no withdrawal restrictions, all while a part of your CHF deposit is used to finance impactful projects via labelled bonds. Earn 0.1% interest on your CHF accounts with 0% fees for foreign card payments, and 0.5% interest on your EUR account3.

We are regulated by the Swiss Financial Market Supervisory Authority (FINMA), so you benefit from high industry standards and Swiss deposit insurance.

.webp)

Pay with your radicant debit card and enjoy free travel protection. Whether it's a beach escape, city adventure, or an epic journey, you're covered from trip cancellation to luggage damage and international health insurance.

With radicant, every transaction can contribute to the restoration of vital ecosystems. With Saveback, you also get up to 10% of your card spending deposited into your investment portfolio.2

Discover the project

A part of your CHF deposit is used to finance impactful projects via labelled bonds.

Stay informed about your CO2 emissions with our radicant footprint tracker. Understand the environmental impact of your spendings and make informed decisions to minimise your footprint.

.webp)

Interest rates may change at any time due to market conditions. Interest rate adjustments take effect at the time of an interest rate change. The applicable interest rates are published on the radicant website. The interest rate is calculated on a daily basis, using the end of the day balance. The total of the interest you accumulated over the year will be paid at year-end.

For cash balances over EUR 250,000, the interest rate is 0%. Interest rates may change at any time due to market conditions. Interest rate adjustments take effect at the time of an interest rate change. The applicable interest rates are published on the radicant website. The interest rate is calculated on a daily basis, using the end of the day balance. The total of the interest you accumulated over the year will be paid at year-end.

Pay at least 50% of your travel costs with your radicant debit card and enjoy free travel insurance.

Please note that some of our services are only available to Swiss residents.

radicant reserves the right to adjust our offering at any time. Adjustments will be made in good faith based on current market conditions or other reasons. Adjustments will be communicated in an appropriate manner.

1 radicant reserves the right to adjust applicable fees at any time.

2 Up to 10% Saveback available during promotional campaigns. Standard Saveback is up to 1% on eligible card spending. Terms and conditions for the Saveback programme apply. Full details available here: Terms & Conditions for the Saveback Programme, Terms and conditions for the Saveback subscription promotion.

3 For CHF accounts: 0.1% on your total balance. For EUR account: 0.5% up to EUR 250,000. 0% over 250,000. Interest rates may change at any time due to market conditions. Interest rate adjustments take effect at the time of an interest rate change without specific notice to clients. The interest rate is calculated on a daily basis, using the end of the day balance. The total of the interest you accumulated over the year will be paid on the 31st of December.

Download app

Verify your identity

Start banking & investing